Grow Your Profitability by 66% with Open Book Management

By Sarah Grace Mohr, COO of MACKEY

According to a 2021 NYU study, the average net income percentage for US companies was just 3%. To be clear, you could invest your money in the stock market and, historically, your returns would be significantly better than that.

Shameless plug: Our clients see much better income percentages than that national average.

And that’s for a number of reasons: a willingness to use data to inform decision-making, a respect for the Prosper for Business process, and the commitment to setting measurable goals as part of their strategic plan.

But, as is always the case, some do better than others.

A while back we started noticing some anecdotal evidence about our clients. To understand it, we tracked a few new data points and were blown away by what we uncovered.

MACKEY clients that involve their team in our process produce 66% more net income on average than clients who do not.

What am I talking about here? Open book management.

You’ve heard us sing its praises before, but now we have the data to back us up.

So, what exactly is open book management? To put it simply, it’s a way of creating transparency by sharing financial information with your team. Essentially you open your books so your employees can see the bigger financial picture.

I know, I know, it sounds terrifying. I bet you’re thinking:

What if they see how much I make, decide I’m greedy, and stop working so hard? Or quit?

What if they see how little I make and lose their respect for me as a leader?

Open book management is some seriously vulnerable shit. But there are ways to do it that give your employees the insight they need to help grow your bottom line without offering up backstage passes to your bank accounts. Keep reading to learn more.

Starting From Financial Literacy Scratch? You Need ‘The 100’

Because financial literacy isn’t taught in most schools (a separate topic, for another day) it’s safe to assume that most of your employees will have a limited understanding of business finances.

And that’s ok! Why should they?

The problem, however, is that if you plan to implement open book management, your team needs to be able to understand what they’re looking at. Without knowing the basics they risk misunderstanding or misinterpreting the data, which has all sorts of implications, most of which aren’t good.

So, before you start preparing spreadsheets to pass out at the next team meeting, you need to invest in a little education. We offer a workshop called ‘The 100,’ specifically designed to help cover the basics of financial literacy in an approachable and engaging way. In the workshop, we cover:

How businesses spend money

How businesses earn money

How businesses make money

Why profit matters

How to read a profit and loss statement

It is, hands-down, my favorite workshop to give, so if you’re interested, hit me up and let’s make it happen.

Whether you partner with us for this foray into financial literacy 101 or take it on yourself, once you’ve given your team the basics, you’re ready to start sharing some financial statements. And that’s where the common-size income statement comes into play.

But SG, What’s a Common-Size Income Statement?

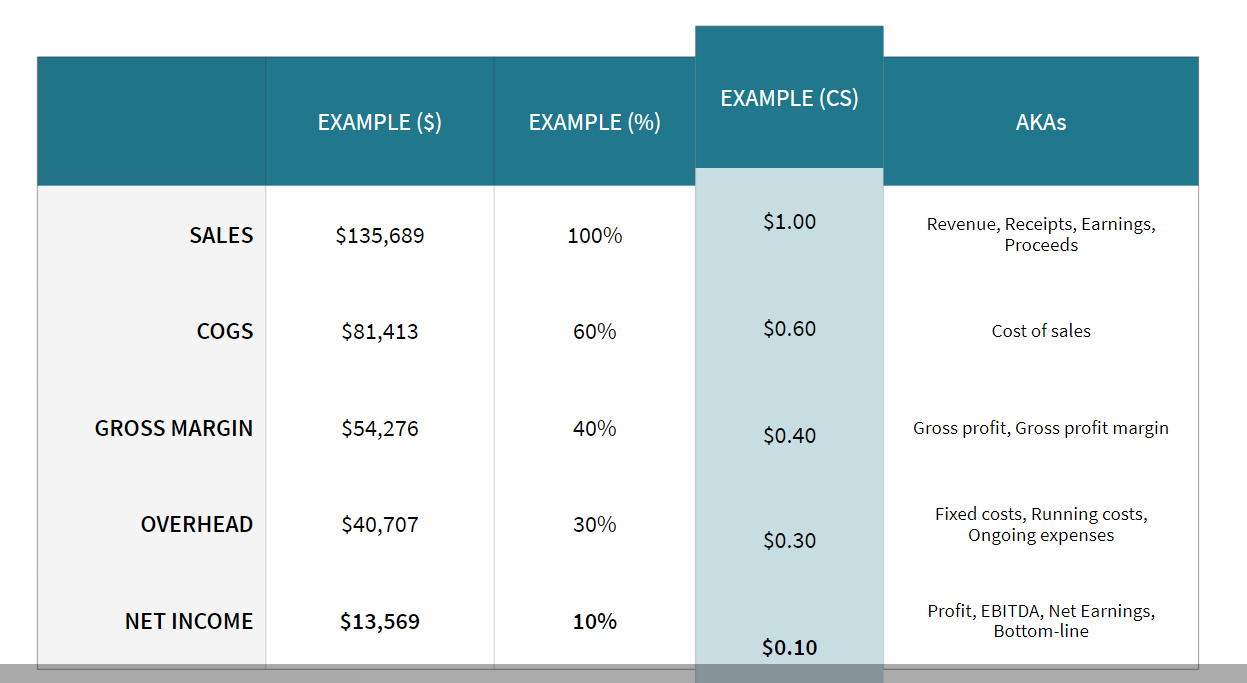

A common-size income statement (also referred to as a common-size profit and loss statement or P&L) expresses the percentages on your profit and loss statement as proportional to a single dollar.

Here’s an example:

The beauty of the common-size income statement is twofold:

1. It adds a layer of protection for the business owner. While your team can see your net income, they don’t have actual dollar amounts at their disposal.

2. It presents financials in quantities easy to conceptualize. Everyone can understand the value of a dollar. But as numbers start getting bigger, it can be hard for those not intimately familiar with the ins-and-outs of a company’s operations to understand the value that is (or isn’t) represented by actual dollar amounts.

SG Soapbox Tangent: Focusing on Profitability Isn’t Selfish

Some business owners are hesitant to dip their toe in the open book management waters because they feel guilty or greedy when emphasizing profitability. Especially for those who are focused on social impact, passionate about living wages, or are aspiring B corps, it can feel counterintuitive to open your books with the goal of actively growing profits. But here’s the thing: Profit is all about putting your oxygen mask on first.

If you’re not making an appropriate profit, you can’t reinvest in your business or in your people. If you’re not making an appropriate profit, you remain trapped in survival mode. And if you’re not making an appropriate profit, you’ll never find someone willing to buy your business, which (in the long run) leaves your beloved team without an employer.

So, yes, charging your team with improving the company’s profitability does benefit you, but it also benefits everyone.

Tasking Your Team With Growing the Bottom Line

The beauty of open book management is that once you’ve given your employees access, you can also empower them to be part of company-wide growth.

Many of us want to make sweeping declarations in pursuit of increased profitability, but the reality is that small changes, over time can yield real results. By focusing on 1% improvements, cumulatively you and your team can make significant gains.

Maybe you decide to decrease material waste or set a supply purchasing policy (and stick to it). Perhaps pursue some automation options or renegotiate raw material costs. As a team:

☑️ Review the numbers

☑️ Identify opportunities

☑️ Set a goal

☑️ Track your progress

☑️ Repeat

It’s a simple process, but it comes with powerful results. It creates buy in. And it builds trust.

And pulling those reports and reviewing numbers will be easier than ever with our soon-to-launch fully digital KPI & KFI dashboard!